Canadian Cannabis Funding

If you are searching for finance strategies to cut CAPEX, fund your Cannabis start up or or raise working capital to grow your business, there are many cannabis business funding options available through the Growth West Funding Strategies & Networks.

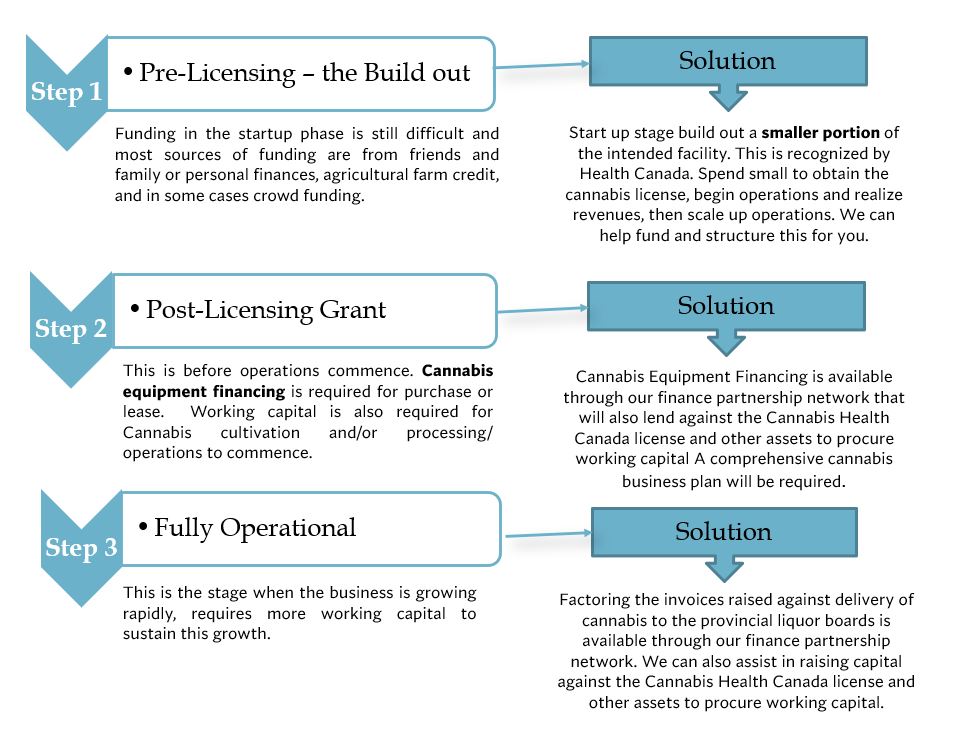

The Start Up Prelicensing Stage -During the Facility Build Out

A large amount of capital expenditure "CAPEX" is required in the build out to meet stringent Health Canada good production practices (GPP) criteria. Health Canada does not require any equipment in the submission of the facility evidence package.

Post Licensing Stage-Funding your Cannabis Operations

The first tranche of capital after Health Canada grants the Cannabis License is for the equipment purchase and working capital to commence Cannabis operations. The second tranche of finance is the stage when the business is growing rapidly and requires more working capital to sustain growth to in turn increase revenues and profits.

Use Growth West's Funding Strategies and Networks

Formulating a comprehensive Cannabis funding and financial strategy essential to both short term and long term business planning along with our funding resources and networks.

CANNABIS FUNDING: CRITICAL ISSUES

START UP STAGE: BUILD OUT

Ask yourself :

- How much funding do you need to start your Cannabis Business?

- What percentage of this funding is your own money?

- What assets to start your business are already owned by you, or your corporation ?

- How much funding do you expect from family, friends acquaintances?

- What lines of credit will be be available using your personal credit rating?

- Do you have a business plan prepared by a Cannabis Business Expert to obtain the funding ?

- Do you have funding network resources available ?

POST LICENSING: PRE-OPERATIONS

Ask yourself:

Equipment Financing/Leasing & Working Capital.

- Do you have cut sheets describing your individual equipment purchases?

- Have you obtained a more than one estimate for your equipment purchase?

- Do you have you proforma invoices for your equipment purchases?

- What is the lag time between purchase and delivery?

- Do you accurately know your working capital requirements?

- How much working capital do you have available?

- Do you have a Cannabis business plan?

POST LICENSING: OPERATIONS

Ask yourself:

- Do you have an accurate calculation of your working capital?

- Do you have pro forma financial projections with financial assumptions?

- Are these based on industry standard empirical metrics?

- Have you unencumbered assets that could be borrowed against?

- Do you have experience in crowd funding?

- Have you been successful in raising capital at Angel forums?

- Do you have a business plan written by a Cannabis expert?

- Do you have an investor deck?

SOLUTIONS TO CANNABIS FUNDING

FINDING CANNABIS FUNDING: HOT BUTTON ISSUES

The Pre-Licensing Stage

This is when the build out of the cultivation and and/or processing facility it takes place. A large CAPEX expenditure is required to meet stringent Health Canada GPP. No equipment is necessary for the evidence package submission.

Funding in the start up phase is difficult and most sources of funding are from friends and family (76%*) or personal finances (25% to 50%*), Grants (2%*), commercial loans (44%*), and in some cases crowdfunding.

However, one of our most recommended strategies is to pursue a phased build out strategy. A small initial spend to obtain the cannabis license; begin operations and realize revenues, then use these to complete the build out and scale up operations.

*Statistics Canada’s Survey of Financing of Small and Medium Enterprises 2007.

2nd Stage Funding: Post Licensing

This stage is directly after the license grant but before commercial operations begin. This is when equipment is purchased or leased and working capital is needed for operations. After a Growth West Business Financial Analysis, our Financing networks will assist in equipment purchase/lease and/or working capital.

Third Stage Funding--Scaling up.

The business is fully operational and generating revenue. With the business growing rapidly more working capital is needed to scale up.

After a Business Financial Analysis , Growth West's funding sources include: factoring invoices, commercial loans and other loan finance. Joint venture and flow through agreements are another means of funding.

Get Cannabis Funding with a Solid Business Plan

PRE LICENSING STAGE

- Determine where the proposed site will be

- Negotiate the commercial lease or purchase of fixed property

- Determine the true extent of the marijuana production premises (Floor Plan) and quantify CAPEX.

- Accurately calculate cannabis production or extraction capacity in terms of floor plan (for use in the License Application)

- Identify the cannabis growing and/or extraction technologies to be used in the a Health Canada License Application

- For Processing: Identify the pre processing and post processing extraction technologies and the HVAC and electrical costs associated with these.

- Complete Growth West's funding application form

- Draft business plan for funding, Health Canada and Revenue Canada.

POST LICENSING STAGE

- Quantify the growing and/or costs of cannabis per gram

- Quantify Capital Expenditure Costs

- Three Year forward pro forma revenues and EBITDA profits with break even

- Ensure accounting records and financials are current.

- Formulate your marketing and marketing communication strategy

- Describe further Cannabis Expansion Plans

- Company Valuation relative to cross section of existing Cannabis Licensed Producers in your license category.

- Update and make current your business plan with pro forma financials

- Complete Growth West's funding application form

Lets Set You Up for Funding

Whatever type of funding you are looking for will depend on a solid financial plan: we need this to inform investors and lenders and we have the knowledge and experience to help you succeed.