Cannabis Business Analysis Process

26% of Canadian Agricultural Startups fail in the first year. (StatsCan Failure Rates for New Canadian Firms: New Perspectives on Entry and Exit). Lack of financial planning and general management are two root causes. Sufficient operational funding is also critical.

According to Health Canada’s recent data, +/- 95 Federal cannabis license holders left the industry, representing 9.7% of licenses issued during that period. But 82 of these are Cultivation Licenses (Micro and Standard).

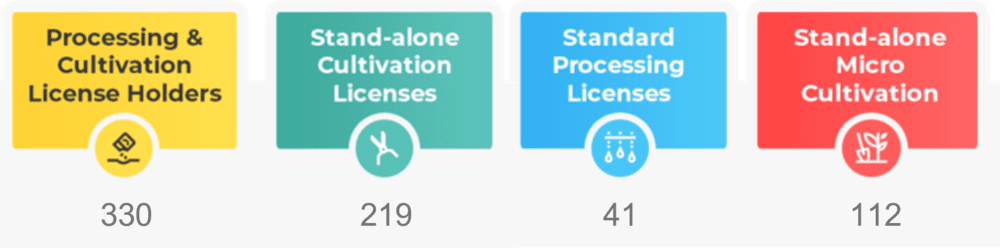

The table below is an analysis of Health Canada’s published list of license holders under the Cannabis regulations comprising all cultivators, processors, and sellers as of as of June 01, 2022.

“Business owners don't plan to fail; they fail to plan”

- There are therefore 661 Cultivation Licenses (without and without processing licenses) using the table above.

- Therefore, using the above StatsCan Failure Rate for Agriculture (26%), this would amount to 171 business failures of the 661 Cultivation Licenses .

- If we acknowledge that there are already 82 cultivation licenses already removed then there would be approximately a further +/- 89 more Cannabis Licencees expect to fail before June 2023 (661 licencees – (82 removed).)

The hot button issues therefore are: which firms are likely to fail and what actions can these businesses take to prevent failure? Have these businesses identified critical problems that will cause their business to fail and quantify what these problems are costing the business?

“Failure isn’t fatal, but failure to change might be.” — John Wooden

A Cannabis Business Analysis and Cannabis Market Analysis is conducted by a Senior Financial Analyst Cannabis or Cannabis Business Analyst who is experienced in in Cannabis Industry Analysis.

A business and financial diagnosis is developed from the analysis for funding and business remediation. The Business Analysis conducted without disruption to your everyday business and at a nominal.

Some of the Areas Examined are:

- Historical & Current Accounting Information

- Human Resources

- Receivables

- Supply Agreements

- Purchasing and Flow Through Agreements

- Cash Flows

- Profits

- Break Even

The Process

Our experienced Senior Cannabis Business Analyst, Nigel Boast B.Sc, LLB, MBA. (analyzed > 100 companies) will review and analyze historical and current financial data and other information to diagnose problems which have a negative impact on profitability and cash flow.

The process begins with an opening interview, which takes approximately an hour. During this time period, the cannabis business owner our Senior Business Analyst participate in an in-depth discussion of the Cannabis business, its history, and your vision for the future Cannabis business opportunities.

Thereafter, after we analyze all accounting information, both past and present, and use this information to identify cash flow or capital shortfalls, and business problems and what these problems are costing your business.

The findings of the analysis is then presented to the business owner within one to two days. This information also assists in funding if this is required.

In this highly regulated taxed environment, with onerous payments to Provincial & Federal Governments, Cannabis companies often lack critical working capital, sufficient cash flow and also business system solutions. This results in financial stress and in some cases business failure.

Using the results from the comprehensive business analysis many companies are now re-evaluating their financial and business planning, rethinking their overall finance strategy seeking new Cannabis funding and finance.

Benefits to the Cannabis business owner in implementing financial and business planning based on the Cannabis Analysis include:

- Increased profits and positive cash flow

- Additional funding and working capital

- Eliminate costly business problems

- Effect positive change

- Increased shareholder value

- Define exit strategy

Our experienced Senior Business Analyst, Nigel Boast B.Sc, LLB, MBA. (analyzed > 100 companies) will review and analyze historical and current financial data and other information to diagnose problems which have a negative impact on profitability and cash flow.

We also offer a fractional on going CFO services depending on client’s needs to execute and implement the Cannabis financial and Cannabis Business plan.