Cannabis Business Financing and Cannabis Funding Solutions

“Financing Constraints now easing for the Canadian Cannabis Industry!”

Anyone involved in a Cannabis business in Canada, excluding public companies, are painfully aware that securing finance or funding is a difficult and harrowing experience. The reason for this inhibiting constraint is that every facet of the Canadian banking system, including credit unions, are linked with their United States counterparts or partner Banks. American banks and financial institutions are constrained by U.S.

Federal law in dealings with the cannabis industry. Canada is a sovereign country and should not be constrained by United States federal laws, but the two countries' business is intertwined.

More recently, there has been an easing of these financial constraints in funding Canadian cannabis business. Now is the time to take advantage of the current business environment.

The following is a discussion of the current landscape in terms of the different solutions and avenues to secure finance to grow your cannabis business successfully.

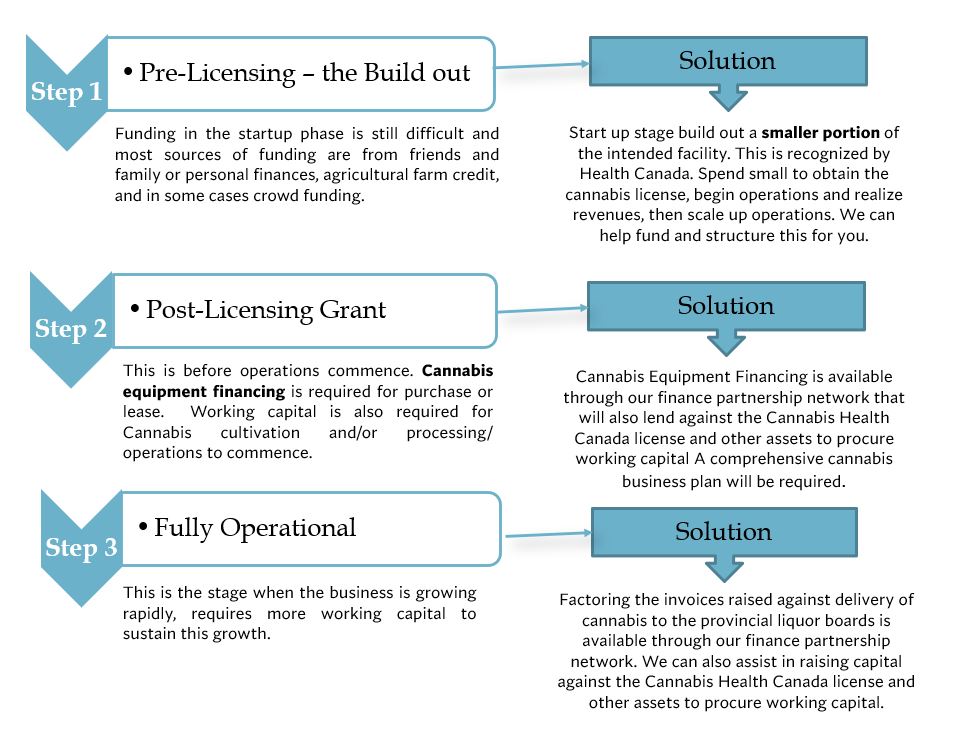

Depending on what stage your business has reached, funding of your cannabis business can be differentiated into three different Stages;

The first stage is pre-licensing: this is when the build out of the cultivation and processing facility is taking place for the evidence package submission to obtain the Cannabis License. Large capital expenditure is required for the build out to meet stringent Health Canada good production practices (GPP) criteria. Although Health Canada does not require any equipment in the submission of the evidence package.

The pre-licensing or start upstage there are no operations and hence no revenues. Up until the present time, asset based loans have been difficult to obtain because of the cannabis financial constraints explained above, but this is now easing. Historically, most sources of funding are from friends and family or personal finances, agricultural farm credit, and in some cases cannabis crowdfunding.

One of the most recommended strategies made to our clients is to pursue a phased build out strategy or what is termed "block by block" build out. This means initially building out a smaller portion of the intended facility. This is recognized by Health Canada as the difficulty in funding is well recognized. The reasons for this approach is simple: a small spend to obtain the cannabis license, begin operations and realize revenues, then use this financial information to fund the scale up operation. In this manner, it is possible to build out successive scaled up operations using previous small business successes. We specialise in phased build outs and also help in saving usually many tens of thousands of dollars in costs and time.

The second stage is post licensing, which is directly after the license has been granted but before commercial operations begin. This is when cannabis equipment financing is required to be purchased or leased and working capital is needed in anticipation of commencement of operations. Fortunately, there are now a few financial institutions in our network that will lend against the Cannabis Health Canada license and other assets to procure working capital. Also, they are a number of financial institutions that will finance equipment purchase after the license grant. A comprehensive cannabis business plan will be required along with other information and guarantees to secure this finance. Additional funding can be supplemented using the friend and family and possibly crowdfunding routes. This funding process uses our financial partnership network and our financial tools to assist our clients.

The third and final stage of funding is the easiest of all three stages. This is when the business is fully operational and is generating invoices against revenue and has a business history. This is the stage when the business is growing rapidly and requires more working capital to sustain this growth the financial tools used here is factoring the invoices raised against delivery of cannabis to the provincial liquor boards, or in the case of medical sales to patients. This will allow for easier cash flow without having to wait extended periods of time before payment by the liquor board. This finance facilitation is achieved using our financial partnership network and other resources we have to assist our clients.

Another avenue to consider in easing cash flow, and also reducing costs is to consider a joint venture with a processor that has importer product partners which will buy the product at predetermined prices and will pay immediately against delivery in the foreign country. A good example of such a joint venture is Everest BioPharma International Inc., in Kelowna BC which offers a cooperative model whereby the cultivator purchases a cooperative membership to receive processing discounts in the domestic market and also export opportunities. Everest BioPharma will also assist the cultivator to obtain good agricultural collection practices (GACP) certification so that the product can be exported by passing the LCQB resulting predetermined prices increased profits, and quicker payments.